Tags: Administration , Best Seller , Corporate , downloadable , Finance , Human Resources , Policy , Template , Word

Special Offer - Business & Financial Plan Template Bundle

- Brand: IMARI Doc Shop

- Availability: In Stock

- SKU: BUNDLE-001

$98.00

$140.00

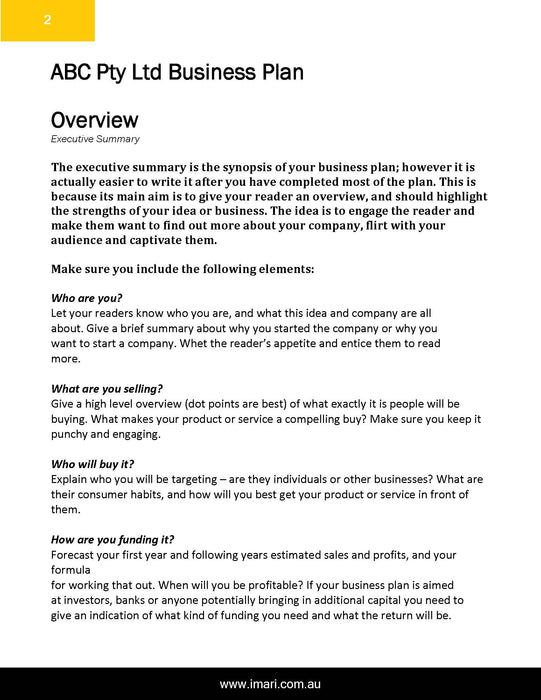

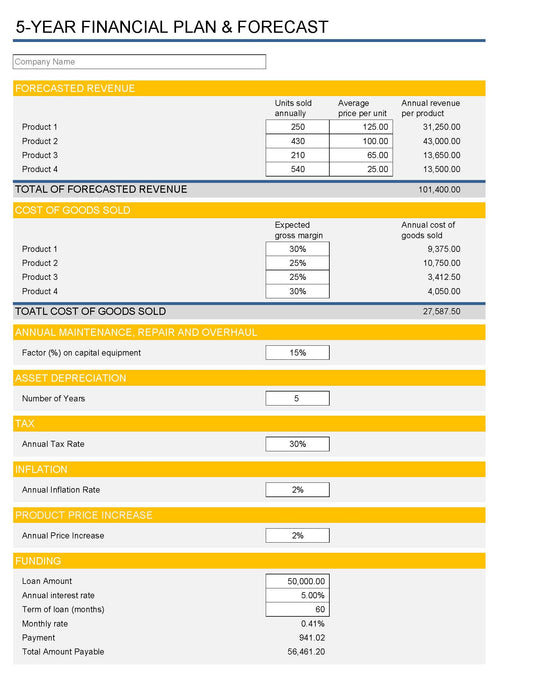

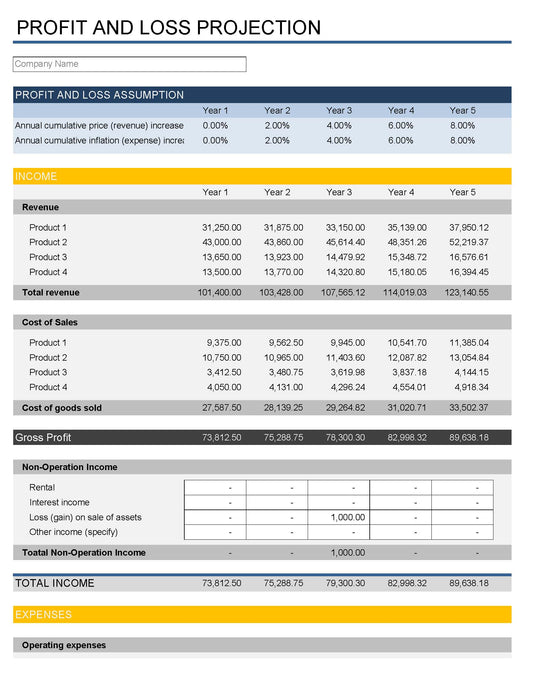

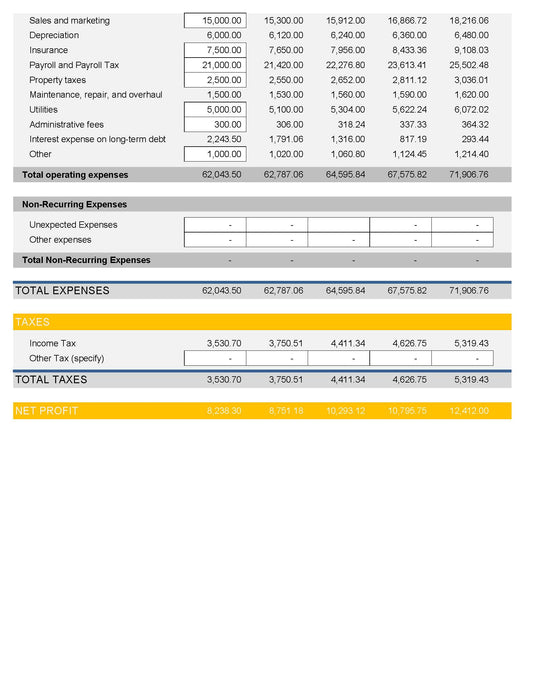

Get the best of our 3 top selling documents all in our bundle discounted at 30% off! Business Plan Template Business Plan Guide Financial Plan Template This is a great bundle for small to medium businesses, who are looking to get some structure and plan for growth. You need the...

Get the best of our 3 top selling documents all in our bundle discounted at 30% off!

This is a great bundle for small to medium businesses, who are looking to get some structure and plan for growth. You need the right tools to guide your business to success, so look no further.

Customer Reviews

The information, guides, templates, forms, instructions, articles, tips and comments provided in and through docushop.com.au is not legal, financial or general business advice, but is and includes general information / forms on issues often encountered, and about business areas designed to help docushop users, members and subscribers address their own business needs. Legal, financial or general business information, including tips, general forms, instructions, comments, and templates, no matter how seemingly customized to conform to the laws of your state, is not the same as legal, financial or general business advice, which may be the specific application of laws by lawyers licensed to practice law in your state to the specific circumstances and needs of individuals and entities. Some states have highly specific laws, and our information / forms may not take those specific laws into consideration. docushop is not a law firm and the employees and contractors (including attorneys, if any) of docushop are not acting as your attorneys, and none of them are a substitute for the advice of your own attorney or law firm licensed to practice law in your state. The employees or contractors of docushop who wrote or modified any form, instructions, tips, comments, templates and guides, are NOT providing legal or any other kind of advice, are not creating or entering into an Attorney-Client relationship, and were most likely NOT prepared or reviewed by an attorney licensed to practice law in your state, and, therefore, could not provide you with advice even if they or docushop wanted to.

Even though we take every reasonable effort to attempt to make sure our information / forms are accurate, up to date, and useful, we recommend that you consult the relevant specialist (lawyer, financial advisor, HR specialist etc) licensed to practice in your state if you want professional assurance that our information, forms, instructions, tips, comments, templates and guides, and your interpretation of it or them, and the information and input that you provide, is appropriate to your particular situation.

The information, forms, instructions, tips, comments, templates and guides available on and through this site is not or are not legal/financial/business advice and is nor or are not guaranteed to be correct, complete or up-to-date. Because the rules & regulations are different from jurisdiction to jurisdiction, changes, and is subject to varying interpretations and applications by different courts and government and administrative bodies, docushop cannot guarantee - - and disclaims all guarantees - - that the information and forms on the site is or are completely current or accurate. Please further note that rules & regulations change and are regularly amended, therefore, the provisions, and names and section numbers of statutes within any document may not be 100% correct as they may be partially or wholly out of date and some relevant ones may have been omitted or misinterpreted. The information, forms, instructions, tips, comments, templates and guides are not a substitute for the advice of your own consultants, lawyers and advisors. You may wish to consult with your own industry professionals practicing in your state to confirm the accuracy of statutory references. No general information or forms like the kind docushop provides can always correctly fit every circumstance.

Information / Forms where you provide information or make choices, even if based upon suggestions or tips provided by docushop, and resulting in a document where that information or the outcome of your choices, does not and is not intended to represent the advice of docushop. These completed or generated documents are no more than self-help forms where you would fill in the information or make the choices as if they were forms with blanks to be completed. docushop is not applying the principles of the laws of your state, including those based upon the information you provide or the choices you make. docushop does nothing more than allow you to pick and choose among various choices or provisions. It is your responsibility to get the completion of the document right.

Note: You should have carefully read and considered the instructions, tips, comments, templates and guides. If you did not you should go back and complete the process again. You must review the completed document to make sure that it meets your specific circumstances and requirements, and the particular laws of your state. docushop does not review your completed document, including for consistency, spelling errors, or any reason at all. You (or your attorney) may want to make additional modifications to meet your specific needs and the laws of your state.

You may want to consider whether you need or should seek financial, legal or licensed third party advice for your specific problem or issue, or if your specific problem or issue is or may be too complex to be addressed by our information or forms, you should consult a licensed professional in your area. You may also consider having an attorney licensed in your area review the document you completed so as to provide you with legal guidance and advice.

All information (which includes available forms) are provided without any warranty, express or implied, including as to their legal effect and completeness. Information and forms should be used as a guide and modified to meet your own individual needs and the rules & regulations of your state. Your use of any information or forms is at your own risk. docushop and any of its employees, contractors, or attorneys who participated in providing any information or forms expressly disclaim any warranty: they are not creating or entering into any Attorney-Client relationship by providing information to you. docushop does not provide legal advice. The information offered by docushop is not a substitute for the advice of your own attorney.

INFORMATION IS PROVIDED "AS IS" WITHOUT ANY EXPRESS OR IMPLIED WARRANTY OF ANY KIND INCLUDING WARRANTIES OF MERCHANTABILITY, NON INFRINGEMENT OF INTELLECTUAL PROPERTY, OR FITNESS FOR ANY PARTICULAR PURPOSE. IN NO EVENT SHALL docushop, OR ITS AGENTS, OFFICERS OR ATTORNEYS BE LIABLE FOR ANY DAMAGES WHATSOEVER (INCLUDING, WITHOUT LIMITATION, DAMAGES FOR LOSS OF PROFITS, BUSINESS INTERRUPTION, LOSS OF INFORMATION) ARISING OUT OF THE USE OF OR INABILITY TO USE THE INFORMATION, EVEN IF docushop HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES.

Communications between you and docushop are NOT protected by the lawyer-client privilege or work product doctrine since docushop is not a professional firm and is not providing professional advice. Please also note that your access to and use of docushop is subject to additional terms and conditions. No docushop employee, contractor, or attorney is authorized to provide you with any advice about what information (again, which includes forms) to use or how to use or complete it or them.