Tags: Best Seller , Excel , Finance , Forecast , Template

5 Year Financial Plan & Forecast

- Brand: IMARI Doc Shop

- Availability: In Stock

- SKU: FIN-100

$20.00

Use this business budget template and 5 year financial plan for your small business to help you understand your financial position, your cashflow and how to plan for the future. Overview of the 5 year financial plan budget template The financial projection template is a useful financial plan example...

Use this business budget template and 5 year financial plan for your small business to help you understand your financial position, your cashflow and how to plan for the future.

Overview of the 5 year financial plan budget template

The financial projection template is a useful financial plan example that will help you to carry out your own financial projections and test your business ideas financial vaibility and stability.

Simply amend the highlighted input elements to suit your purposes, and the financial projections template does the rest.

Download this financial projection Excel template to calculate your startup expenses, payroll costs, sales forecast, cash flow, income statement, balance sheet, break-even analysis, financial ratios, cost of goods sold, amortization and depreciation for your business.

Whilst the template takes into consideration startup costs, any business new or existing can use this template to forward plan their finances for 5 years.

Benefits of having a Business Budget Template

-

Accelerate profitability

-

Give peace of mind your finances are in order

-

Help you reach your goals quicker

-

Assures business growth

-

Helps avoid debt or plan for cashflow dips

-

Smooth running of operations

Adopting this business budget template and forecast template within your small business budget is a simple and effective way to get clarity on your finances. Financial planning does not have to be difficult, budgeting should be simple and straight forward. If you are not used to forecasting our how to use section will cover off everything you need to know.

This business budget template is what our senior consultants use when first sitting down with any new business they work with. Whether a startup company that needs budget forecasting for an investor or a bank, or a large business looking at restructuring or improving their profit / bottom line - they use this same business budget template as a starting point.

When to Use thie Small Business Budget Template

Whether you are already running a business, or making plans to start one up, financial planning is a vital part of ensuring your success. Not knowing your expected income and expenditure will make it difficult to plan, and hard to find investors.

This 5-Year Financial Plan spreadsheet will make it easy for you to calculate profit and loss, view your balance sheet and cash flow projections, as well as calculate any loan payments you may have. Whilst the wording on this spreadsheet is focussed around products, it can just as easily be used for businesses who largely provide services to their customers.

How to Use our Business Budget Template

Model Inputs

Use the Model Inputs sheet to enter information about your business that will be used to model results seen on the other pages.

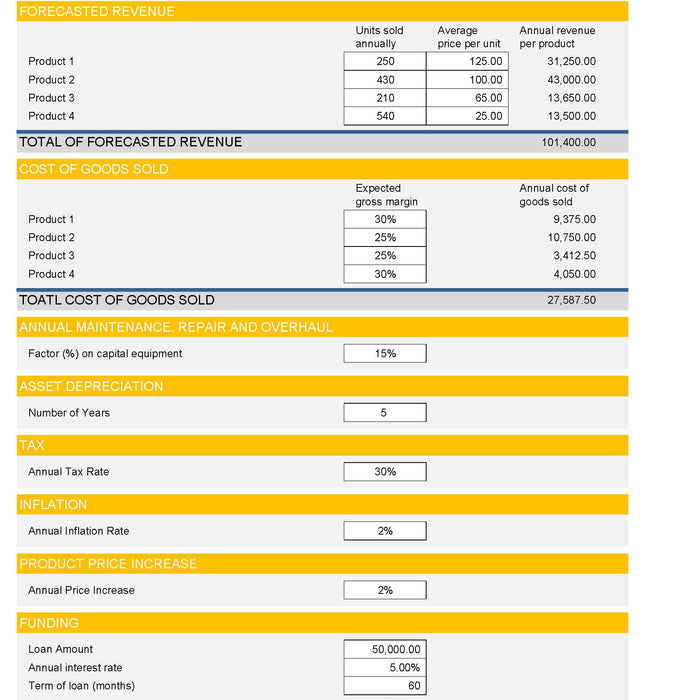

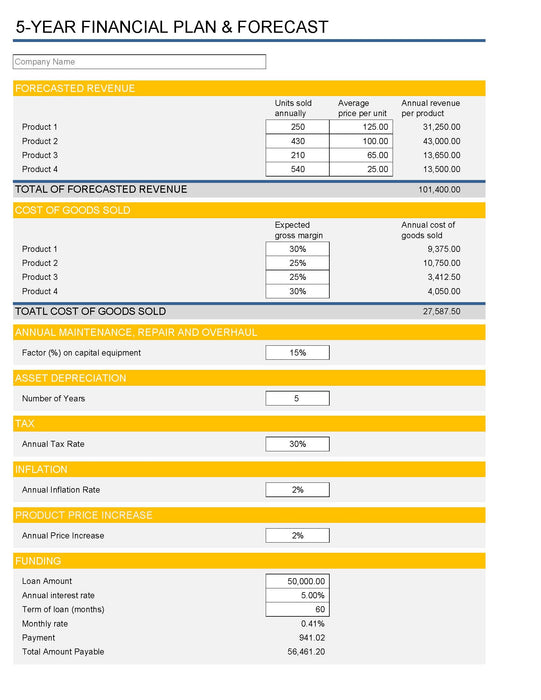

Forecasted Revenue

The forecasted revenue section allows you to estimate your revenue for 4 different products. Simply use the white boxes to enter the number of units you expect to sell, and the price you expect to sell them for, and the spreadsheet will calculate the total revenue for each product for the year. If you want to give your products names, simply type over the words “Product 1”, “Product 2” etc. and these names will be carried through to the rest of the spreadsheet.

Cost of Goods Sold

Your margins are unlikely to be the same on all of your products, so the cost of goods sold allows you to enter your expected gross margin for each product into the white boxes in Column B. The spreadsheet will automatically calculate the annual cost of goods sold based on this information, along with your forecasted revenue.

Annual Maintenance, Repair and Overhaul

As the cost of annual maintenance, repair and overhaul is likely to increase each year, you will need to enter a percentage factor on your capital equipment in the white box in Column B. This will be used to calculate your operating expenses in the profit and loss sheet.

Asset Depreciation

Use the white box to enter the number of years you expect your assets to depreciate over. This may vary greatly from business to business, as assets in some sectors depreciate much more quickly than they do in others.

Tax

In most parts of the world, you will have to pay income on your earnings. Enter the annual tax rate that applies to your circumstances in the white box in Column B. If you have to pay any other taxes, these can be entered later on the Profit and Loss sheet.

Inflation

Although you cannot be certain of the level of inflation, you will still need to try and plan for it when coming up with a 5-year financial plan. The International Monetary Fund provide forecasts for a number of countries, so is a good place to look if you are unsure what to enter here. Simply enter your inflation rate in the white box.

Product Price Increase

As a consumer, you are no doubt aware that the price of products goes up over time. Enter a number in the white box to show the expected annual price increase of your products to enable the spreadsheet to calculate income in future years. If you are unsure what to put here, increasing your product price in line with inflation is a good starting point. If your business is just starting out, you may be able to command higher prices for your products or services as the years go on, as you build up brand recognition and a good reputation.

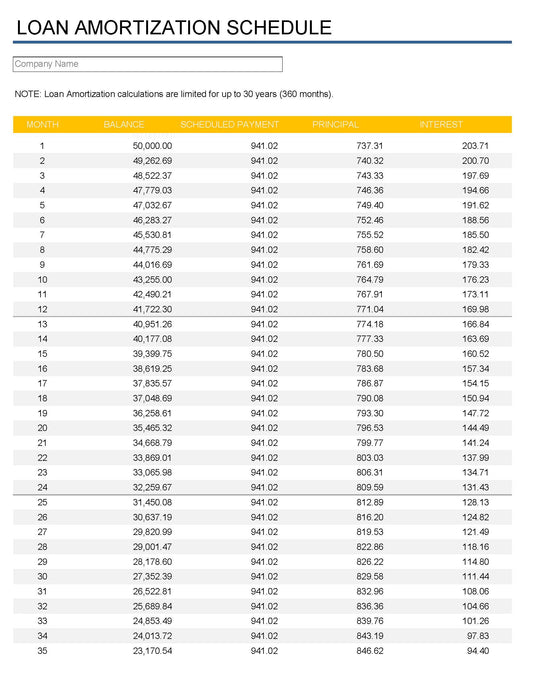

Funding

The funding section allows you to enter information about your business loan. To use this section, simply fill in the three white boxes representing the amount of the loan, the annual interest rate and the term of the loan in months – for example, 12 for 1 year, 24 for 2 years, 36 for 3 years, 48 for 4 years, or 60 for a 5 year loan.

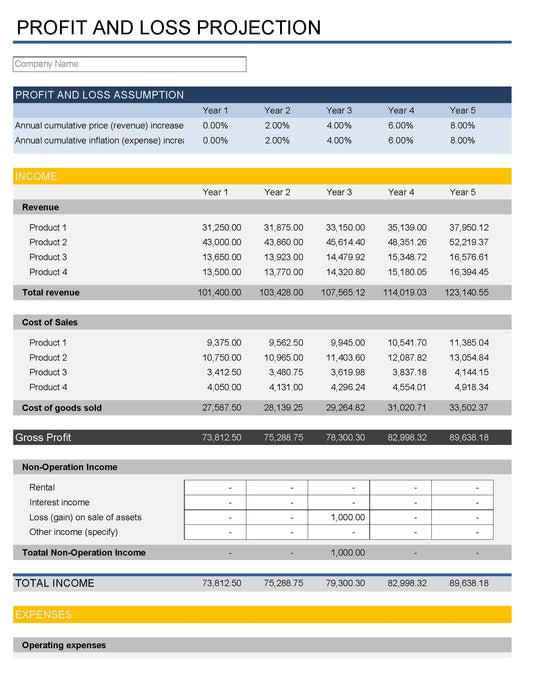

Profit and loss

This sheet calculates your profit and loss for each year over a 5 year period. The profit and loss assumptions, along with income, are automatically calculated using information entered in the model inputs sheet.

Non-Operation Income

You may have, or be expecting some income in addition to your operating income. These can be entered manually in the white cells in Column B for Year 1, Column C for Year 2 and so on. There are pre-entered categories for rental, lost income and loss (or gain) on the sale of assets, as well as an additional row where you can enter your own non-operation income.

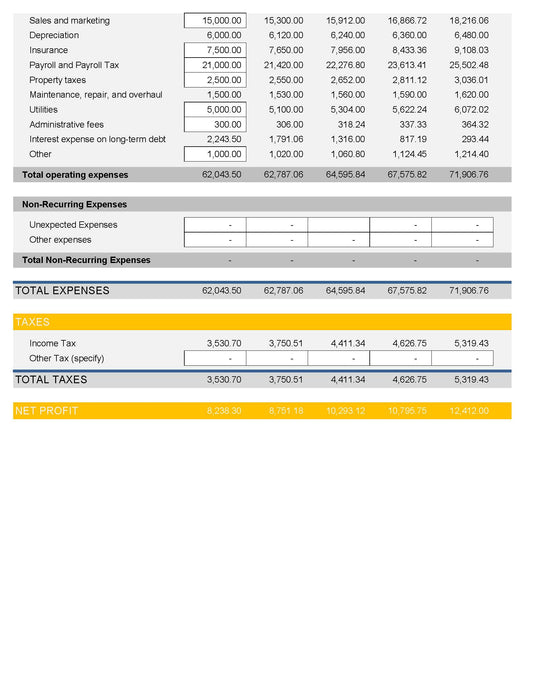

Operating Expenses

Some parts of this are already filled in based on information you put on the Model Inputs, for example, depreciation, maintenance and interest on long-term debt. Years 2-5 are also filled in for you across all categories based on the inflation information entered in the Model Inputs sheet. You therefore only need to enter your Sales and Marketing, Insurance, Payroll and Payroll Tax, Property Taxes, Utilities, Administration Fees and any Other Expenses into the white cells in Column B for Year 1.

Non-recurring Expenses

This section is for entering any expenses that you will not be paying on an annual basis. The Unexpected Expenses row allows you to enter a contingency for unexpected expenses, whilst the Other Expenses row allows you to enter any other one off expenses you may be expecting to make, for example the purchase of new equipment part way into your 5 year plan.

Taxes

Income Tax is filled in based on the information you enter into the model inputs. Depending on where your business is based, you may find yourself having to pay other taxes. These can be entered in the Other Tax row. You can rename this row by typing over the “Other Tax (specify)” text.

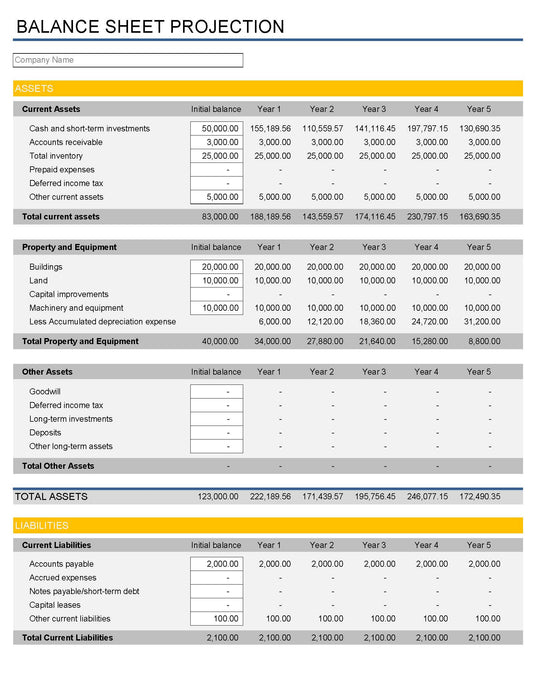

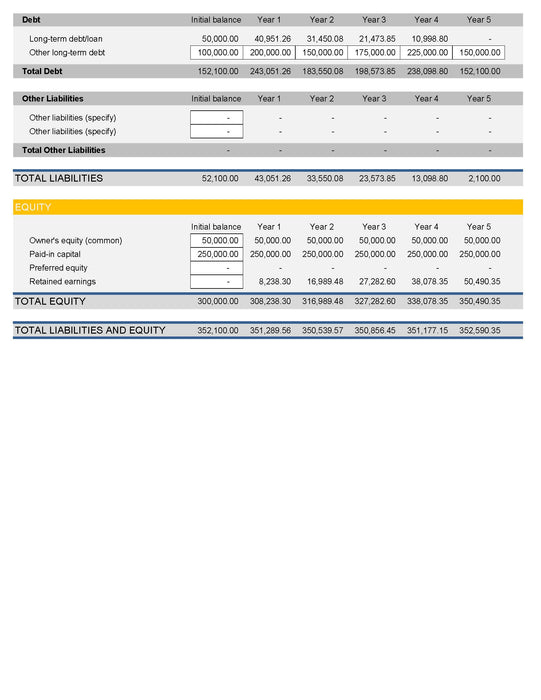

Balance Sheet

The annual balances for Years 1-5 are, in most cases, filled in for you, based on the information you have entered on the Model Inputs sheet and in the Initial Balance column of the Balance Sheet column itself. This makes it very easy to use.

Current Assets

This is where you can enter the value of any of your current assets, with spaces to enter information about Cash and Short-term Investments, Accounts Receivable, Inventory, Prepaid Expenses and Deferred Income Tax. At the bottom of this section is a space for you to enter any other current assets you may have that do not fall into any of these categories.

Property and Equipment

Depending on the nature of your business, you may have assets such as Buildings, Land, Capital Improvements and Machinery. Enter the value of these assets into Column B, and these values will be copied over to each of the 5 years of the plan. The depreciation information entered into the Model Inputs sheet will be used to calculate the depreciation expenses, which allows a total for property and equipment to be calculated automatically.

Other Assets

This section is for entering information on any assets that don’t fit in the other sections. These could be Goodwill Payments, Deferred Income Tax, Long-term Investments, Deposits, or any Other long-term assets. Enter the information into Column B, and it will be carried across to the yearly columns automatically.

Current Liabilities

As well as assets, your business is likely to have liabilities. There are spaces to enter Accounts Payable, Accrued Expenses, Notes Payable and Short-term Debt, Capital Leases and Other current liabilities. Just leave blank any rows where you do not have any liabilities, and the totals will be calculated for you.

Debt

Your long-term debt/loan information will have already been entered in the Model Inputs sheet, so the only thing to do here is to enter any other long-term debt. Unlike much of the rest of the Balance Sheet, you can manually enter different amounts for each year, as you may, for example, be expecting to take on another loan to purchase some new equipment in Year 3 as your business expands.

Other Liabilities

Use this section to enter any liabilities not covered by the pre-defined labels. You can amend the text in Column A, in order to specify the liabilities, and then enter the cost of these liabilities in Column B.

Equity

Your business is likely to have some equity, and this can be entered into this section. You can fill out the Owner’s Equity, Paid-in Capital and Preferred Equity in Column B. Your retained earnings are automatically calculated based on the Profit and Loss sheet.

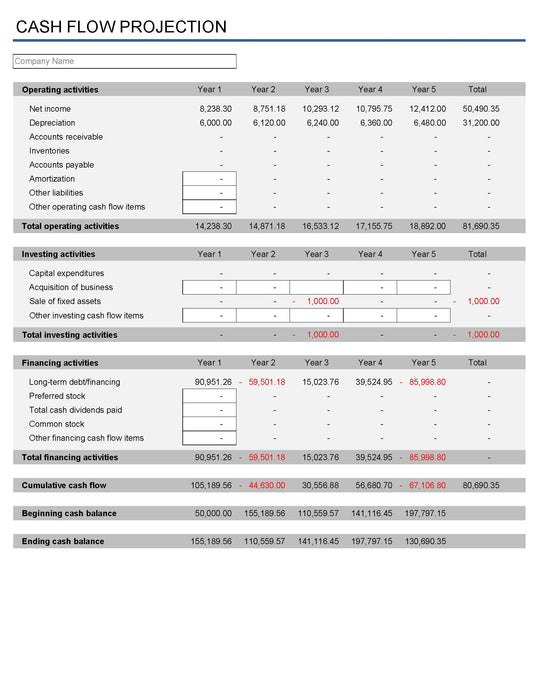

Cash Flow

Much of the information on the cash flow sheet is based on calculations in the Balance Sheet. It is important to plan your cash flow carefully, so that you know what funds you will have available to buy new stock and equipment.

Operating Activities

Much of this section is automatically filled in based on your balance sheet. There are only three rows to fill out, which are Amortization, Other Liabilities and Other Operating Cash Flow. You only need to fill out the white boxes in Column B for Year 1, as these values will automatically be carried over into subsequent years for you.

Investing Activities

Your capital expenditures and sale of fixed assets will be automatically populated if you have filled out the relevant sections of the Balance Sheet. They will be blank if they do not apply. As investing activities can vary year on year, you will need to fill out any investment activities for each of the 5 years in the appropriate columns for Acquisition of Business, and any Other Investing Cash Flow items.

Financing Activities

The long-term debt/financing row will be pre-filled based on the loan information previously entered. Use Column B to fill out your Preferred Stock, Total Cash Dividends Paid, Common Stock and Other Financing Cash Flow items for Year 1. This information will automatically carried over to Years 2-5.

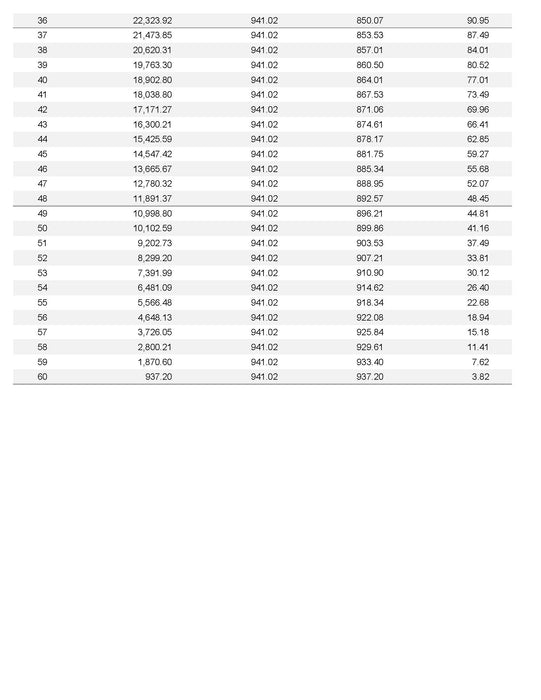

Loan Payment Calculator

There is nothing to enter on this sheet, as it is for information only. Whether or not you already have a loan, or are using this spreadsheet as a part of a business plan to help you obtain one, it allows you to easily see how much you will be paying each month, showing how much you are paying off your loan, and how much you are paying in interest. This will allow you to get an idea of whether or not you can afford to borrow a bit extra, if you feel it would allow you to push your business into higher places, or whether you need to shop around for a better interest rate or adjust the loan term in order to afford the loan payments.

Customer Reviews

The information, guides, templates, forms, instructions, articles, tips and comments provided in and through docushop.com.au is not legal, financial or general business advice, but is and includes general information / forms on issues often encountered, and about business areas designed to help docushop users, members and subscribers address their own business needs. Legal, financial or general business information, including tips, general forms, instructions, comments, and templates, no matter how seemingly customized to conform to the laws of your state, is not the same as legal, financial or general business advice, which may be the specific application of laws by lawyers licensed to practice law in your state to the specific circumstances and needs of individuals and entities. Some states have highly specific laws, and our information / forms may not take those specific laws into consideration. docushop is not a law firm and the employees and contractors (including attorneys, if any) of docushop are not acting as your attorneys, and none of them are a substitute for the advice of your own attorney or law firm licensed to practice law in your state. The employees or contractors of docushop who wrote or modified any form, instructions, tips, comments, templates and guides, are NOT providing legal or any other kind of advice, are not creating or entering into an Attorney-Client relationship, and were most likely NOT prepared or reviewed by an attorney licensed to practice law in your state, and, therefore, could not provide you with advice even if they or docushop wanted to.

Even though we take every reasonable effort to attempt to make sure our information / forms are accurate, up to date, and useful, we recommend that you consult the relevant specialist (lawyer, financial advisor, HR specialist etc) licensed to practice in your state if you want professional assurance that our information, forms, instructions, tips, comments, templates and guides, and your interpretation of it or them, and the information and input that you provide, is appropriate to your particular situation.

The information, forms, instructions, tips, comments, templates and guides available on and through this site is not or are not legal/financial/business advice and is nor or are not guaranteed to be correct, complete or up-to-date. Because the rules & regulations are different from jurisdiction to jurisdiction, changes, and is subject to varying interpretations and applications by different courts and government and administrative bodies, docushop cannot guarantee - - and disclaims all guarantees - - that the information and forms on the site is or are completely current or accurate. Please further note that rules & regulations change and are regularly amended, therefore, the provisions, and names and section numbers of statutes within any document may not be 100% correct as they may be partially or wholly out of date and some relevant ones may have been omitted or misinterpreted. The information, forms, instructions, tips, comments, templates and guides are not a substitute for the advice of your own consultants, lawyers and advisors. You may wish to consult with your own industry professionals practicing in your state to confirm the accuracy of statutory references. No general information or forms like the kind docushop provides can always correctly fit every circumstance.

Information / Forms where you provide information or make choices, even if based upon suggestions or tips provided by docushop, and resulting in a document where that information or the outcome of your choices, does not and is not intended to represent the advice of docushop. These completed or generated documents are no more than self-help forms where you would fill in the information or make the choices as if they were forms with blanks to be completed. docushop is not applying the principles of the laws of your state, including those based upon the information you provide or the choices you make. docushop does nothing more than allow you to pick and choose among various choices or provisions. It is your responsibility to get the completion of the document right.

Note: You should have carefully read and considered the instructions, tips, comments, templates and guides. If you did not you should go back and complete the process again. You must review the completed document to make sure that it meets your specific circumstances and requirements, and the particular laws of your state. docushop does not review your completed document, including for consistency, spelling errors, or any reason at all. You (or your attorney) may want to make additional modifications to meet your specific needs and the laws of your state.

You may want to consider whether you need or should seek financial, legal or licensed third party advice for your specific problem or issue, or if your specific problem or issue is or may be too complex to be addressed by our information or forms, you should consult a licensed professional in your area. You may also consider having an attorney licensed in your area review the document you completed so as to provide you with legal guidance and advice.

All information (which includes available forms) are provided without any warranty, express or implied, including as to their legal effect and completeness. Information and forms should be used as a guide and modified to meet your own individual needs and the rules & regulations of your state. Your use of any information or forms is at your own risk. docushop and any of its employees, contractors, or attorneys who participated in providing any information or forms expressly disclaim any warranty: they are not creating or entering into any Attorney-Client relationship by providing information to you. docushop does not provide legal advice. The information offered by docushop is not a substitute for the advice of your own attorney.

INFORMATION IS PROVIDED "AS IS" WITHOUT ANY EXPRESS OR IMPLIED WARRANTY OF ANY KIND INCLUDING WARRANTIES OF MERCHANTABILITY, NON INFRINGEMENT OF INTELLECTUAL PROPERTY, OR FITNESS FOR ANY PARTICULAR PURPOSE. IN NO EVENT SHALL docushop, OR ITS AGENTS, OFFICERS OR ATTORNEYS BE LIABLE FOR ANY DAMAGES WHATSOEVER (INCLUDING, WITHOUT LIMITATION, DAMAGES FOR LOSS OF PROFITS, BUSINESS INTERRUPTION, LOSS OF INFORMATION) ARISING OUT OF THE USE OF OR INABILITY TO USE THE INFORMATION, EVEN IF docushop HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES.

Communications between you and docushop are NOT protected by the lawyer-client privilege or work product doctrine since docushop is not a professional firm and is not providing professional advice. Please also note that your access to and use of docushop is subject to additional terms and conditions. No docushop employee, contractor, or attorney is authorized to provide you with any advice about what information (again, which includes forms) to use or how to use or complete it or them.